29. Some Unpleasant Monetarist Arithmetic

29.1Overview¶

This lecture builds on concepts and issues introduced in Money Financed Government Deficits and Price Levels.

That lecture describes stationary equilibria that reveal a Laffer curve in the inflation tax rate and the associated stationary rate of return on currency.

In this lecture we study a situation in which a stationary equilibrium prevails after date , but not before then.

For , the money supply, price level, and interest-bearing government debt vary along a transition path that ends at .

During this transition, the ratio of the real balances to indexed one-period government bonds maturing at time decreases each period.

This has consequences for the gross-of-interest government deficit that must be financed by printing money for times .

The critical money-to-bonds ratio stabilizes only at time and afterwards.

And the larger is , the higher is the gross-of-interest government deficit that must be financed by printing money at times .

These outcomes are the essential finding of Sargent and Wallace’s “unpleasant monetarist arithmetic” Sargent & Wallace (1981).

That lecture described supplies and demands for money that appear in lecture.

It also characterized the steady state equilibrium from which we work backwards in this lecture.

In addition to learning about “unpleasant monetarist arithmetic”, in this lecture we’ll learn how to implement a fixed point algorithm for computing an initial price level.

29.2Setup¶

Let’s start with quick reminders of the model’s components set out in Money Financed Government Deficits and Price Levels.

Please consult that lecture for more details and Python code that we’ll also use in this lecture.

For , real balances evolve according to

or

where

- is real balances at the end of period

- is the gross rate of return on real balances held from to

The demand for real balances is

where .

29.3Monetary-Fiscal Policy¶

To the basic model of Money Financed Government Deficits and Price Levels, we add inflation-indexed one-period government bonds as an additional way for the government to finance government expenditures.

Let be a time-invariant gross real rate of return on government one-period inflation-indexed bonds.

With this additional source of funds, the government’s budget constraint at time is now

Just before the beginning of time 0, the public owns units of currency (measured in dollars) and units of one-period indexed bonds (measured in time 0 goods); these two quantities are initial conditions set outside the model.

Notice that is a nominal quantity, being measured in dollars, while is a real quantity, being measured in time 0 goods.

29.3.1Open market operations¶

At time 0, government can rearrange its portfolio of debts subject to the following constraint (on open-market operations):

or

This equation says that the government (e.g., the central bank) can decrease relative to by increasing relative to .

This is a version of a standard constraint on a central bank’s open market operations in which it expands the stock of money by buying government bonds from the public.

29.4An open market operation at ¶

Following Sargent and Wallace Sargent & Wallace (1981), we analyze consequences of a central bank policy that uses an open market operation to lower the price level in the face of a persistent fiscal deficit that takes the form of a positive .

Just before time 0, the government chooses subject to constraint (6).

For ,

while for ,

where

We want to compute an equilibrium sequence under this scheme for running monetary and fiscal policies.

Here, by fiscal policy we mean the collection of actions that determine a sequence of net-of-interest government deficits that must be financed by issuing to the public either money or interest bearing bonds.

By monetary policy or debt-management policy, we mean the collection of actions that determine how the government divides its portfolio of debts to the public between interest-bearing parts (government bonds) and non-interest-bearing parts (money).

By an open market operation, we mean a government monetary policy action in which the government (or its delegate, say, a central bank) either buys government bonds from the public for newly issued money, or sells bonds to the public and withdraws the money it receives from public circulation.

29.5Algorithm (basic idea)¶

We work backwards from and first compute associated with the low-inflation, low-inflation-tax-rate stationary equilibrium in Inflation Rate Laffer Curves.

To start our description of our algorithm, it is useful to recall that a stationary rate of return on currency solves the quadratic equation

Quadratic equation (10) has two roots, .

For reasons described at the end of Money Financed Government Deficits and Price Levels, we select the larger root .

Next, we compute

We can compute continuation sequences of rates of return and real balances that are associated with an equilibrium by solving equation (2) and (3) sequentially for :

29.6Before time ¶

Define

Our restrictions that imply that .

We want to compute

Thus,

We can implement the preceding formulas by iterating on

starting from

29.7Algorithm (pseudo code)¶

Now let’s describe a computational algorithm in more detail in the form of a description that constitutes pseudo code because it approaches a set of instructions we could provide to a Python coder.

To compute an equilibrium, we deploy the following algorithm.

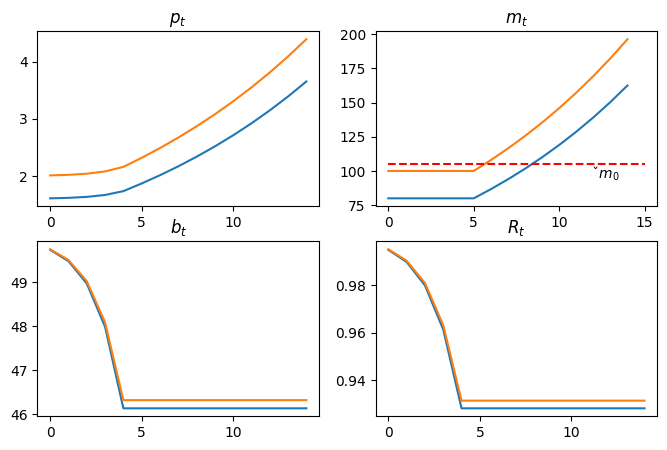

29.8Example Calculations¶

We’ll set parameters of the model so that the steady state after time is initially the same as in Inflation Rate Laffer Curves

In particular, we set . We set in that lecture, but now the counterpart will be , which is endogenous.

As for new parameters, we’ll set .

We’ll study a “small” open market operation by setting .

These parameter settings mean that just before time 0, the “central bank” sells the public bonds in exchange for units of currency.

That leaves the public with less currency but more government interest-bearing bonds.

Since the public has less currency (its supply has diminished) it is plausible to anticipate that the price level at time 0 will be driven downward.

But that is not the end of the story, because this open market operation at time 0 has consequences for future settings of and the gross-of-interest government deficit .

Let’s start with some imports:

import numpy as np

import matplotlib.pyplot as plt

from collections import namedtupleNow let’s dive in and implement our pseudo code in Python.

# Create a namedtuple that contains parameters

MoneySupplyModel = namedtuple("MoneySupplyModel",

["γ1", "γ2", "g",

"R_tilde", "m0_check", "Bm1_check",

"T"])

def create_model(γ1=100, γ2=50, g=3.0,

R_tilde=1.01,

Bm1_check=0, m0_check=105,

T=5):

return MoneySupplyModel(γ1=γ1, γ2=γ2, g=g,

R_tilde=R_tilde,

m0_check=m0_check, Bm1_check=Bm1_check,

T=T)msm = create_model()def S(p0, m0, model):

# unpack parameters

γ1, γ2, g = model.γ1, model.γ2, model.g

R_tilde = model.R_tilde

m0_check, Bm1_check = model.m0_check, model.Bm1_check

T = model.T

# open market operation

Bm1 = 1 / (p0 * R_tilde) * (m0_check - m0) + Bm1_check

# compute B_{T-1}

BTm1 = R_tilde ** T * Bm1 + ((1 - R_tilde ** T) / (1 - R_tilde)) * g

# compute g bar

g_bar = g + (R_tilde - 1) * BTm1

# solve the quadratic equation

Ru = np.roots((-γ1, γ1 + γ2 - g_bar, -γ2)).max()

# compute p0

λ = γ2 / γ1

p0_new = (1 / γ1) * m0 * ((1 - λ ** T) / (1 - λ) + λ ** T / (Ru - λ))

return p0_newdef compute_fixed_point(m0, p0_guess, model, θ=0.5, tol=1e-6):

p0 = p0_guess

error = tol + 1

while error > tol:

p0_next = (1 - θ) * S(p0, m0, model) + θ * p0

error = np.abs(p0_next - p0)

p0 = p0_next

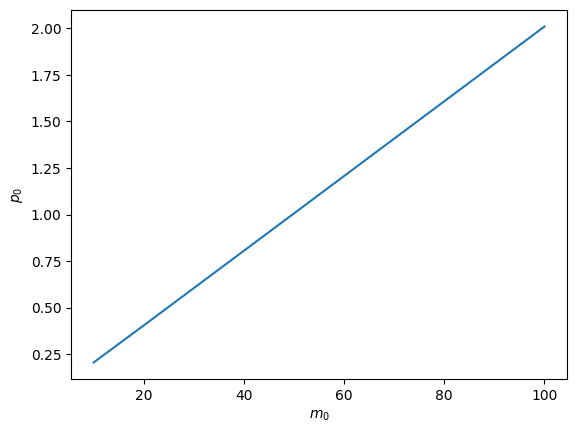

return p0Let’s look at how price level in the stationary equilibrium depends on the initial money supply .

Notice that the slope of as a function of is constant.

This outcome indicates that our model verifies a quantity theory of money outcome, something that Sargent and Wallace Sargent & Wallace (1981) purposefully built into their model to justify the adjective monetarist in their title.

m0_arr = np.arange(10, 110, 10)plt.plot(m0_arr, [compute_fixed_point(m0, 1, msm) for m0 in m0_arr])

plt.ylabel('$p_0$')

plt.xlabel('$m_0$')

plt.show()

Now let’s write and implement code that lets us experiment with the time 0 open market operation described earlier.

def simulate(m0, model, length=15, p0_guess=1):

# unpack parameters

γ1, γ2, g = model.γ1, model.γ2, model.g

R_tilde = model.R_tilde

m0_check, Bm1_check = model.m0_check, model.Bm1_check

T = model.T

# (pt, mt, bt, Rt)

paths = np.empty((4, length))

# open market operation

p0 = compute_fixed_point(m0, 1, model)

Bm1 = 1 / (p0 * R_tilde) * (m0_check - m0) + Bm1_check

BTm1 = R_tilde ** T * Bm1 + ((1 - R_tilde ** T) / (1 - R_tilde)) * g

g_bar = g + (R_tilde - 1) * BTm1

Ru = np.roots((-γ1, γ1 + γ2 - g_bar, -γ2)).max()

λ = γ2 / γ1

# t = 0

paths[0, 0] = p0

paths[1, 0] = m0

# 1 <= t <= T

for t in range(1, T+1, 1):

paths[0, t] = (1 / γ1) * m0 * \

((1 - λ ** (T - t)) / (1 - λ)

+ (λ ** (T - t) / (Ru - λ)))

paths[1, t] = m0

# t > T

for t in range(T+1, length):

paths[0, t] = paths[0, t-1] / Ru

paths[1, t] = paths[1, t-1] + paths[0, t] * g_bar

# Rt = pt / pt+1

paths[3, :T] = paths[0, :T] / paths[0, 1:T+1]

paths[3, T:] = Ru

# bt = γ1 - γ2 / Rt

paths[2, :] = γ1 - γ2 / paths[3, :]

return pathsdef plot_path(m0_arr, model, length=15):

fig, axs = plt.subplots(2, 2, figsize=(8, 5))

titles = ['$p_t$', '$m_t$', '$b_t$', '$R_t$']

for m0 in m0_arr:

paths = simulate(m0, model, length=length)

for i, ax in enumerate(axs.flat):

ax.plot(paths[i])

ax.set_title(titles[i])

axs[0, 1].hlines(model.m0_check, 0, length, color='r', linestyle='--')

axs[0, 1].text(length * 0.8, model.m0_check * 0.9, r'$\check{m}_0$')

plt.show()Fig. 1 summarizes outcomes of two experiments that convey messages of Sargent and Wallace Sargent & Wallace (1981).

An open market operation that reduces the supply of money at time reduces the price level at time

The lower is the post-open-market-operation money supply at time 0, lower is the price level at time 0.

An open market operation that reduces the post open market operation money supply at time 0 also lowers the rate of return on money at times because it brings a higher gross of interest government deficit that must be financed by printing money (i.e., levying an inflation tax) at time .

is important in the context of maintaining monetary stability and addressing the consequences of increased inflation due to government deficits. Thus, a larger might be chosen to mitigate the negative impacts on the real rate of return caused by inflation.

- Sargent, T. J., & Wallace, N. (1981). Some unpleasant monetarist arithmetic. Federal Reserve Bank of Minneapolis Quarterly Review, 5(3), 1–17.

Creative Commons License – This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International.